For better or for worse, the electric power industry in the United States is a balkanized system, which consists of multitudes of regulatory structures, business models, siloed markets, and disparate planning paradigms. The best example of this balkanization is found in the differences between the worlds of generation and transmission that was created because of market deregulation in the late 1990s.

Generation can be market-based, and many areas of the country require generators to compete amongst themselves to sell electricity, ensuring the lowest cost to consumers for electricity (but not including grid reliability services). On the other hand, transmission is a natural monopoly, and the need for it is determined by the utility, or perhaps the Independent Service Operator, and a regulator.

While many generators live and die by market revenues, transmission owners get their costs recovered through rates approved by their regulator, as well as a healthy return on their investment. For decades, these two industries have been siloed, but energy storage is changing all that.

Energy storage, including pumped storage, can be an energy user or an energy producer. In this way, it is like transmission except instead of moving electricity from point to point, energy storage moves power through time.

Pumped Storage Hydro (PSH) has a long history of providing a multitude of transmission services, which include: voltage control, thermal management, stability services, and others. This is true within the framework of a vertically integrated utility where the portfolio effects of PSH are clearly recognized and valued.

PUMPED STORAGE: A ‘DUAL USE’ ASSET?

You may have the question: Doesn’t it make sense for pumped storage to perform as a dual-use asset?

Yes, it does, and in a 2017 policy statement, the Federal Energy Regulatory Commission (FERC) agreed. A dual-use asset in this instance refers to an asset providing transmission services while also competing to provide generation products.

Yet, the fragmented nature of these two industries makes the proposition exceedingly difficult.

When FERC opened the door for dual-use assets, it punted all the thorny issues to the Regional Transmission Organizations (RTO) and Independent System Operators (ISO) to figure it out.

So far, little progress has been made.

Thankfully, Pacific Northwest National Laboratories (PNNL) recently released a paper outlining principles for how pumped storage, and all storage resources, can play in both worlds without upsetting the applecart.

While it is my belief (and I’m willing to be proven wrong) the pathway for pumped storage to be selected as a transmission asset is unlikely to happen in organized markets (more on that below), it may be possible in other regions.

I still believe the strong value PSH can provide, as both generation and transmission assets, makes it more attractive to vertically integrated utilities, who can recognize this value without having to merge these two incongruous industries.

First off, PNNL researchers did a fantastic job of articulating the challenges and obstacles in allowing a storage resource to be a dual-use asset.

Here are just a handful of the major challenges:

Lack of clarity for how and when storage will be considered – Currently, FERC Order 1000 requires all areas of the United States to engage in regional planning. This means that utilities must communicate with their neighbors to determine the most efficient way for the transmission system to be built.

Without regional planning, it’s likely we would build a lot of unneeded transmission, increasing costs with no additional value. A transmission line is not the only solution. Order 1000 required transmission planners to consider non-transmission alternatives like demand response and energy storage.

One big problem with this model is illustrated in the following scenario:

You are a transmission owner who receives a guaranteed 9% rate of return on transmission investments, and you also oversee planning the system. In this case, you naturally have the incentive to view every problem as needing another transmission line.

This issue is less of a concern in areas of the country where the ISO has greater control over planning. Still, it’s hard to know when and how a PSH developer can offer its project into the planning process as a potential solution.

Double recovery of costs – FERC’s policy statement made clear that a dual use storage owner should not be allowed to recover all its costs through regulated rates, and then, when not using the asset for transmission, to make money from generation. Excessive market use would degrade the asset, leaving the customers who paid for the transmission services harmed because the storage asset would wear out quicker.

Is it bad policy to allow for dual use assets to be grossly oversized to the transmission need, and thereby encouraging them to recover more costs in the energy market, ultimately causing a shorter useful life? What do you do with the market revenues? Do you credit them back to transmission customers or allow revenue sharing between owner and customer? There are complex issues such as how and when the asset can perform generation functions.

Avoiding harmful market impacts – By allowing a dual use asset to provide transmission service and generation, then there could be harm to competitive markets because the dual use asset would have an unfair advantage. For instance, the storage owner would likely not have to pay interconnection costs while other participants would.

If not properly mitigated, a dual use asset could low-ball its bids into the energy markets as it was recovering most of its costs through transmission rates. Competitive generation owners would then claim harm because they couldn’t compete against a regulated asset.

Disconnect between transmission and generation planning processes – If a transmission planning process identifies a need, then the planners must have certainty the solution will be implemented in time. Otherwise, reliability is threatened. If that solution is a PSH facility, then there would be considerable risk the project would not receive all the approvals in time.

On the other hand, the non-transmission assets carry the considerable market risk that they may never get built, which is cold comfort for a transmission owner who needs to solve the reliability problem with some level of certainty.

Fortunately, the PNNL researchers came up with a dual-use energy storage participation framework.

These principles include:

- Establish market participation windows in advance – Dual use PSH owners need to know how and when they can provide transmission services and when, and under what circumstances, they can provide market services. This knowledge will allow them to better forecast revenues. Unfortunately, depending on the transmission services they would be mandated to provide, this can be very difficult to forecast.

- Create flexible market products and resource definitions – A dual use asset’s daily performance, as both a transmission and generation resource, can be complex. Sometimes market rules do not always allow for consideration of complicated constraints on an asset’s dispatchability. Allowing for flexible inclusion of these assets into market products would be helpful.

- Balance cost recovery mechanisms to incent market participation – The researchers offer several revenue-sharing concepts which seek to balance the asset owner’s ability to recover investment costs while not jeopardizing the transmission function, as well as reducing harm to market participants.

This new energy storage participation framework provides a useful guide for FERC, the ISOs, developers, and other stakeholders because it encourages dual use assets to perform both functions while minimizing impacts to customers and the market.

IS THIS A FOOL’S ERRAND?

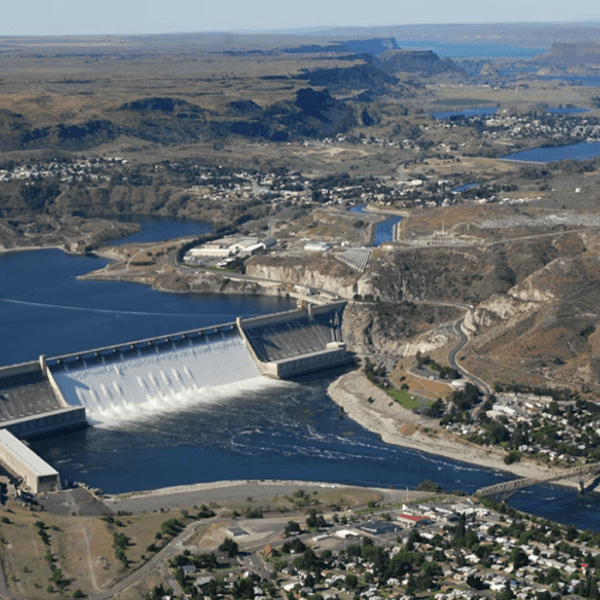

Yes and no. The Achilles’ heel to the path for pumped storage hydro being selected as a transmission asset is that pumped storage, by its nature, will almost always be grossly oversized to the identified transmission need. For example, in the most recent PJM regional transmission plan, no identified solution was more than $90 million. While that may seem like a lot of money, PSH projects routinely cost more than $1 billion.

An oversized transmission asset, especially a 500 MW to 1,000 MW PSH project, will likely have a large impact on generation markets. Other generators would rightfully question whether that PSH facility would have been built absent the transmission rate recovery.

In addition, transmission planners would be reluctant to select a PSH project to solve a transmission need because the risk of the project receiving all federal, state, and local permitting would be uncertain. Batteries are a more likely dual-use asset as their development timeline is shorter and the permitting process less rigorous.

But it’s not all gloom and doom. I do believe that in non-RTO regions, a vertically integrated utility could recognize both the generation and transmission value of PSH through an integrated resource plan (this is precisely how all the PSH projects in the Eastern Interconnect were built and financed).

These areas of the country do not have robust competitive markets, so some of the challenges mentioned above could be skirted.

Still, PNNL’s paper provides a valuable model for developers to consider. I am skeptical that it will lead to an RTO selecting PSH as a transmission solution, but I hope I am proven wrong.