The clean energy transition is posing lots of challenges for the power industry. The largest of these challenges is how to balance the electric transmission system and maintain reliability for a grid that’s dominated by weather-dependent resources like wind and solar. After all, the sun never shines at night, and the wind never blows exactly when we need it.

Right now, the daily wind and solar dips are covered by firm or flexible resources like nuclear, hydropower (and pumped storage), demand response, and natural gas. But what happens when solar and wind are the dominant resources?

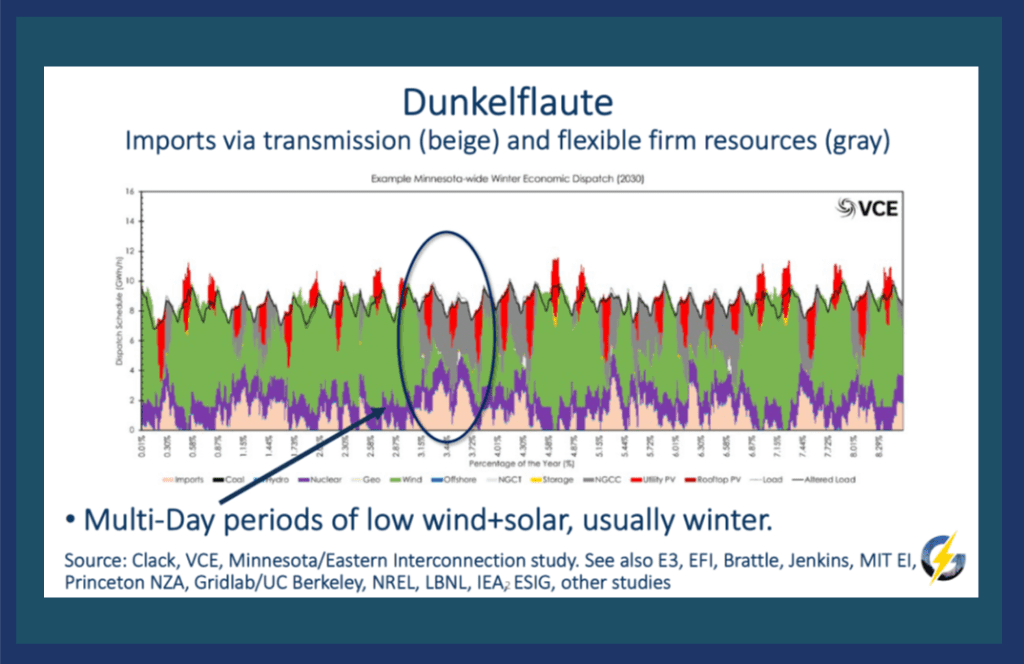

Enter the “Dunkelflaute” or “dark doldrums,” which are sustained wind and solar droughts over days or even weeks. The chart below demonstrates a forecasted Dunkelflaute in Minnesota during the winter of 2030. The chart shows that as many as 3.7% hours, which is equal to two weeks, of doldrums could occur during severe wind and solar droughts.

How can we provide market incentives for new and existing resources to be at the ready when it’s time to bring us out of the doldrums? Also, how do we balance the transmission system on a daily basis?

These were the questions that representatives of National Hydropower Association (NHA) member organizations and electric power experts tackled during a NHA Markets Committee symposium on March 10, 2022. NHA invited national power experts, regulators, and consultants to provide their thoughts on solving these issues with an eye toward what that means for hydropower and pumped storage.

NEW PRODUCTS OR MORE OF WHAT WE ALREADY HAVE?

“We are going to be paying generators a lot less for energy and a lot more to be available to provide energy.” This was the prediction of a senior government official discussing the future needs of the electric transmission grid. As wind and solar are deployed in greater numbers, the price of energy is likely to be extremely cheap in most hours. In theory, the non-energy services (the poorly named ‘ancillary services’) will be in greater demand and become more vital to the reliability of the system.

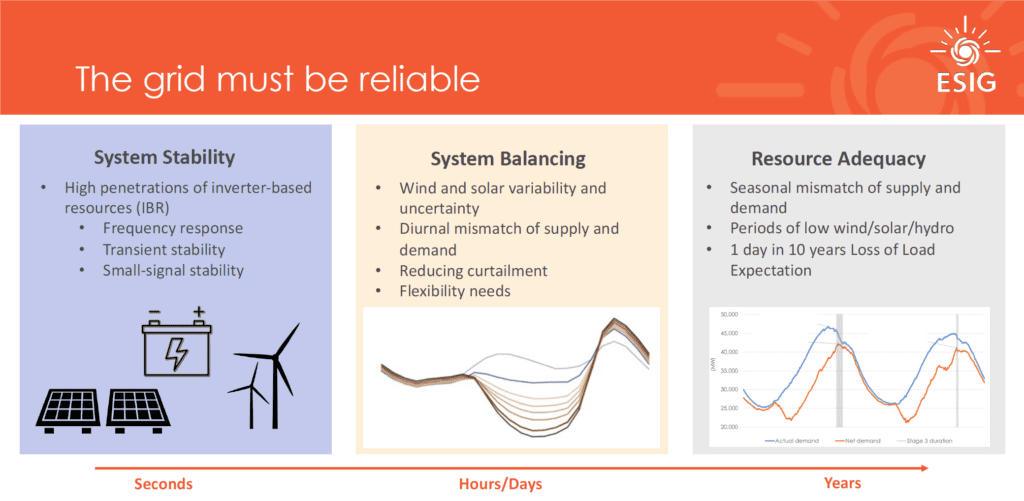

A senior system engineer divided these grid services based on timescales (see chart below).

System Stability

As more inverter-based resources replace spinning mass generators, the need for inertia, frequency response, and regulation will grow. Think of inertia as a big shock absorber that blunts large changes in frequency. Without inertia and regulation, the grid is more susceptible to blackouts or power quality issues.

The good news? Hydropower and pumped storage are capable of providing system stability services. Already, hydropower and pumped storage provide a significant amount of stability services, especially in the Western Interconnect. In addition, hydro and PSH can operate in condenser mode, which helps the system manage reactive power needs.

The bad news? Currently, services like inertia are mostly uncompensated in organized markets. This is because the transmission system has had an abundance of traditional generators to provide stability support. But with the shift to inverter-based resources, that is quickly changing.

System Balancing

Renewable-rich resource states like California have already been dealing with challenges related to balancing net load variability — net load equals load minus wind and solar output. This includes steep evening ramps when solar drops off just as demand peaks.

Ramping is a product created to address this issue and it is currently included in three organized markets (CAISO, SPP and MISO), but has yet to spread to other areas. In part, this is because the need for ramping is not there yet (ISO-NE), or there is already another product like ORDC — operating reserve demand curve (ERCOT, PJM).

Most hydropower and pumped storage already provide significant ramping services in CAISO, receiving almost 40% of total revenue in 2020 while only representing 12% of total capacity.

While ramping products are a great way to pre-position the system for expected ramping demand (i.e., addressing the daily duck curve in California), more operators are recognizing the need to prepare for more unexpected changes in system operation. For instance, several factors can throw a wrench into a grid operator’s day, such as: demand forecast errors, wind and solar forecast mistakes, resource availability, and performance issues.

Present operating reserves are used to cover the largest contingency on the system like a large generator tripping offline or a transmission outage; however, some areas including PJM have instituted an operating reserve demand curve (ORDC), which introduces scarcity pricing into the operating reserve market.

What does this mean?

Currently, most regional transmission organizations (RTOs) do not value holding operating reserves above the NERC-mandated requirement. Yet, with the added operational uncertainties mentioned above, operators are seeing a need to hold more reserves to cover scenarios like an over-forecasting of wind and solar. The ORDC will price these “excess reserves” based on the value of lost load, which will increase their price in stressed times and provide more revenue to resources like hydropower and pumped storage.

This is a good thing, and other RTOs should follow PJM’s and ERCOT’s lead.

Resource Adequacy

How much a generator contributes to resource adequacy is called capacity accreditation (here is a deeper dive on the issue). For instance, a natural gas plant is usually accredited near its nameplate capacity because it can usually provide full output any time of the year.

Wind and solar facilities are another story. These resources rarely provide their full output during net peak demand and are therefore given a lower accreditation value, which provides lower revenues in a capacity market.

Experts at the NHA Markets Committee symposium agreed that the clean energy transition demands that we take a closer look at the way in which we accredit capacity. One method discussed was the Effective Load Carrying Capability (ELCC), which considers the correlated outage risks for resources. Wind and solar resources depend on the same fuel source, the wind or sun, and therefore they both experience an outage at the same time, which reduces their resource adequacy availability. The same issue goes for natural gas. If four natural gas generators are connected to the same pipeline, the risk increases that they will experience an outage due to an inability to get fuel at the right time.

Markets need to consider these issues and accredit resources accordingly.

In most areas of the country, hydropower already receives a reduced accreditation due to the water variability year to year. It’s time for all other resources to receive the same scrutiny.

KEY TAKEAWAYS FOR MARKET REFORM

Although the March 10 NHA Markets Committee symposium raised more questions than the group could answer, a few key takeaways for market reform were considered:

- RTOs and ISOs need to take a closer look at capacity accreditation for all resources including wind, solar, and natural gas generators who may have supply issues (one way to do this is through the effective load carrying capability or marginal ELCC method)

- RTOs should consider valuing operating reserves in scarcity conditions, such as an ORDC, and for ISO-NE, specifically, there needs to be a day-ahead operating reserve market

- For RTOs with large net load variabilities, a ramping product should be considered to more efficiently position the system

- If some capacity resources provide less value in real time than others, then a way to distinguish these value differences should be developed to incent more flexible generators

- Stability services like inertia, fast frequency response, and reactive power should be adequately compensated